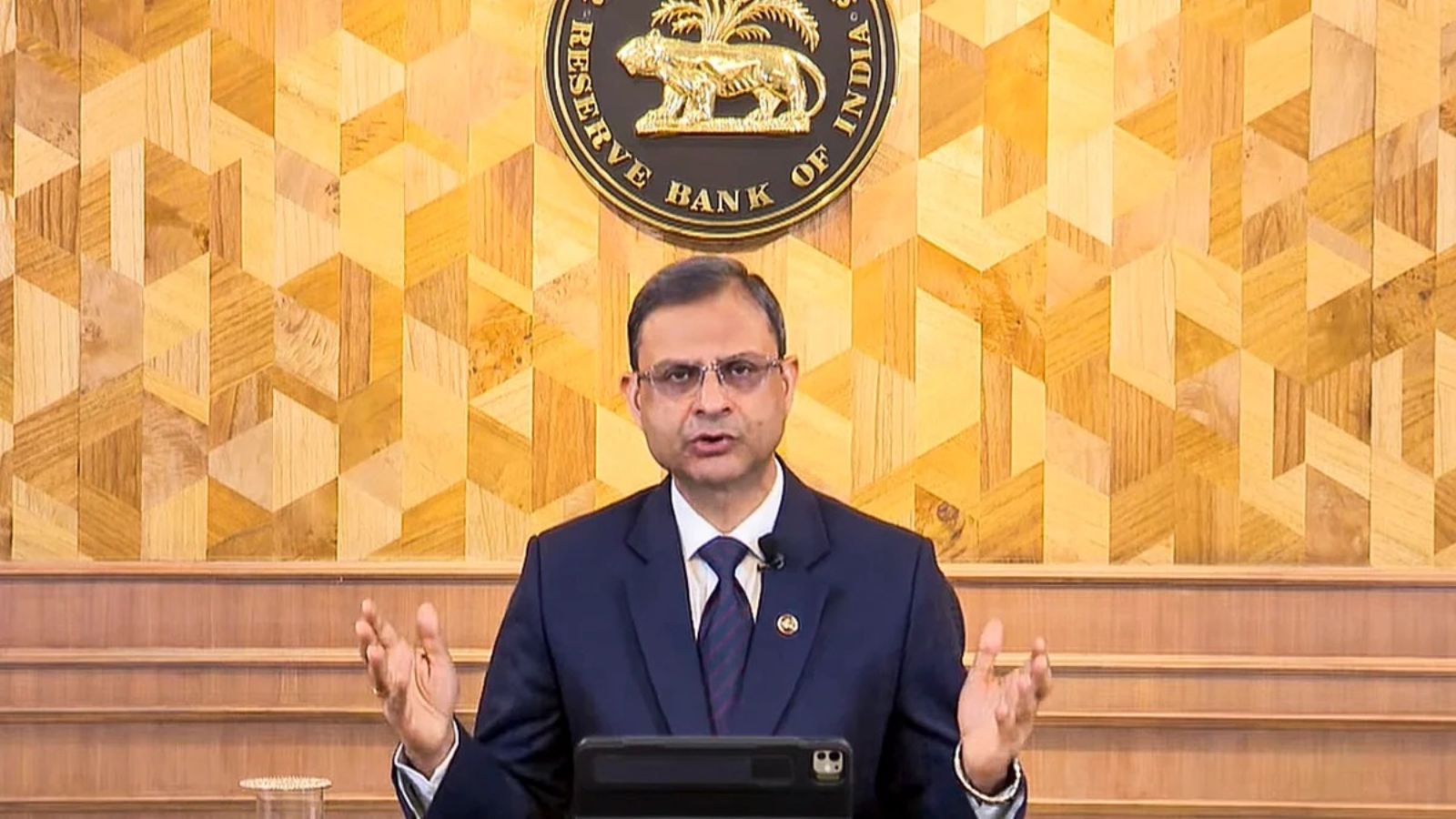

The Reserve Bank of India has given a big relief to the common people by cutting the repo rate by 0.25 percent. This cut will reduce the EMI of the people and loans can also become cheaper. RBI Governor Sanjay Malhotra has announced this decision after the meeting.

Rates were reduced in the year 2020

Let us tell you that RBI last changed the repo rate in the year 2020. RBI had cut it by 0.40% and made it 4%. However, in May 2022, the Reserve Bank started a series of interest rate hikes, which stopped in May 2023. During this time, the Reserve Bank increased the repo rate by 2.50% and took it to 6.5%. In this way, the repo rate has been reduced after 5 years.

Will your EMI decrease?

With the reduction in the repo rate, the common people are wondering whether their interest will be affected or not. So let us tell you that there are 2 types of loans, one is fixed and the other is floater. In a fixed loan, the increase or decrease in the repo rate does not affect your loan. Whereas in a floater loan, the change in the repo rate affects your interest rates. In such a situation, the EMI of people whose loans are floater will be reduced.